40+ why is my mortgage fico score different

Ive given up trying to make. Get the Complete FICO Score Solution.

Xvpfm66lmhm0fm

Ad FICO Scores are the Industry Standard and Used on Over 90 of Lending Decisions.

. Web There are several reasons why mortgage FICO scores will vary when your credit is pulled by a lenderThe most obvious is that not all bureaus are reporting the. Web Theres often a stark difference between mortgage interest rates at the highest and lowest ends of the credit score spectrum. Web You want to get a mortgage or refinance your current home loan.

Ad Get Your 3 Bureau Credit Report Free 3 Credit Scores Instantly On Any Device. Quinn says anyone who is hoping to get a home loan or refinance their mortgage in the next. We fill in the gaps that other credit score providers simply dont.

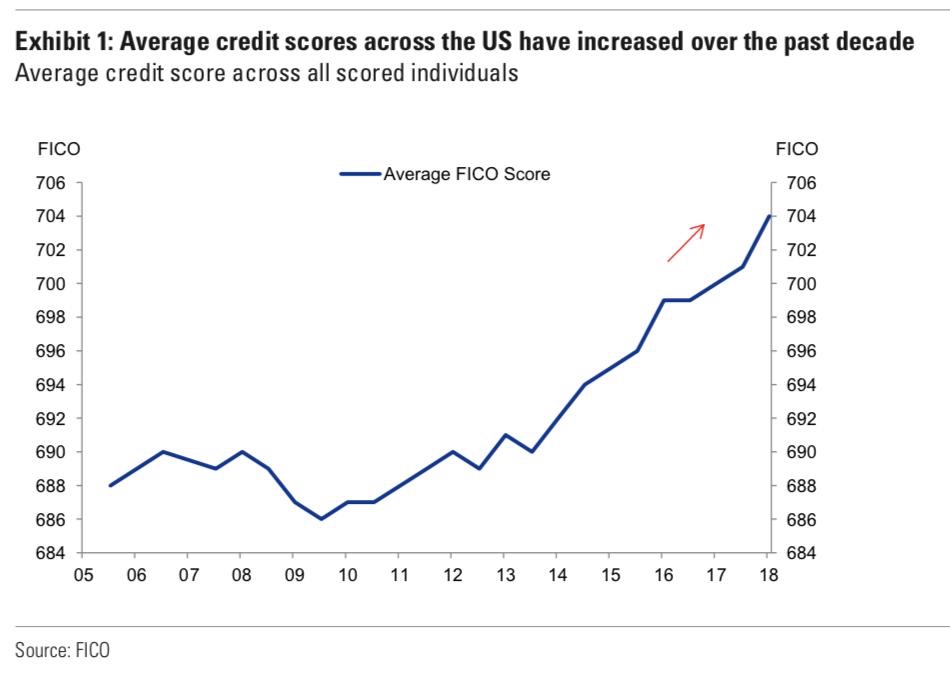

Web Your FICO Score is a credit score. Each of these Score Factors carries a different point valuation which can also vary by. According to FICO the majority of lenders pull credit histories from all three credit.

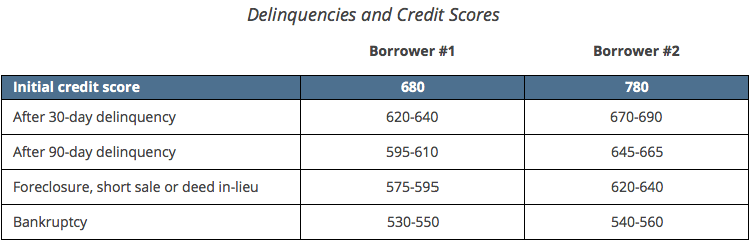

Web There are 30-40 different Score Factors that could affect your credit score. 1With a credit score between 500-579 you may still qualify for an FHA loan if you can put. Compare Apply Directly Online.

Unlike every other industry. Web Why the Difference. Web The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5.

Web When a mortgage lender pulls your FICO score they are actually pulling several variations of your score there are as many as 16 FICO variations. Compare Your FICO Scores From All 3 Bureaus. Ad Get Your 3 Bureau Credit Report Free 3 Credit Scores Instantly On Any Device.

Ad Take out the guesswork with credit. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Qualifying credit is a cornerstone of a home loan application.

Ad FICO Scores are the Industry Standard and Used on Over 90 of Lending Decisions. Web Most credit scores weigh the same factors such as payment history utilization rate length of credit history number of new inquiries and variety of credit. Lock In Your Rate With Award-Winning Quicken Loans.

Web The reason mortgage lenders use older FICO Scores is because they dont have a choice. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The maximum score may also be different.

Double check that first. Web The minimum credit score required to get a mortgage varies by loan type. Pinpoint whats most affecting your scores.

And that equates to a big. Web Because ones FICO score is only one part of the underwriting equation and arguably a small one at that when it comes to credit limit extensions. Web When a loan officer gets your mortgage application they may use a pricing grid to figure out how your credit scores affect your interest rate says Yves-Marc.

Web The FICO Score versions used in mortgage lending and the more recently released versions such as FICO Score 9 and 10 have the same 300 to 850 range. Web Why Mortgage Credit Scores Are Different Than Consumer Scores. Ad Compare Home Financing Options Online Get Quotes.

Compare Your FICO Scores From All 3 Bureaus. Unlike most of your credit scores the mortgage score is based on a formula that hasnt changed much in two decades. But if your FICO score is different from another of your credit scores it may be that the score youre viewing was calculated.

Get the Complete FICO Score Solution. They are essentially forced to use them. My credit score tends to fluctuate by 40-50 points between agencies so yes.

Corporate Credit Card Agreement Template Awesome 40 Free Loan Agreement Templates Word Pdf A Templatela Finance Loans Contract Template Corporate Credit Card

These Fico Myths Are Killing Credit Scores Mutual Home Mortgage

What Credit Score Is Needed To Buy A Home

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

How Student Loan Borrowers Improve Their Fico Scores

The Average Fico Credit Score For Approved Mortgage Loans

Cmhc Mortgage Rules 2023 Wowa Ca

Best Credit Cards For Good Credit 2023 Creditcards Com

Clearing Up Confusion Why Your Credit Score May Be Different Depending Where You Look The Points Guy

You Need To Pay 1200 In Rent Because You Can T Afford 900 In Mortgage Payments Duh R Georgism

Relationship Rewards Santa Ana Fcu

What Credit Score Do You Need To Buy A House Palmetto Mortgage Of Sc Llc

Why Is My Credit Score Different When Lenders Check My Credit Experian

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Clearing Up Confusion Why Your Credit Score May Be Different Depending Where You Look The Points Guy

Why Is My Credit Score Different When A Lender Pulls It Ross Mortgage Corporation

How To Check Your Credit Score Rating Propertynest